December Market Snapshot + What Sellers Need to Know Heading Into 2026

BC Assessment notices have officially landed in mailboxes across Pemberton and the Sea-to-Sky—and yes, they tend to arrive with the same enthusiasm as a January hydro bill. That said, they often spark important (and timely) conversations about value, equity, and next steps—especially as we head into a new year.

A quick reminder: BC Assessment values are based on market conditions as of July 1, 2025, not today’s market. If your assessment feels a little optimistic—or simply doesn’t reflect what your property would realistically sell for—you have until the end of this month to file an appeal. An inaccurate assessment can directly impact your property taxes, so it’s worth a second look. If you’d like help comparing your assessment to current market data, I’m always happy to review it with you.

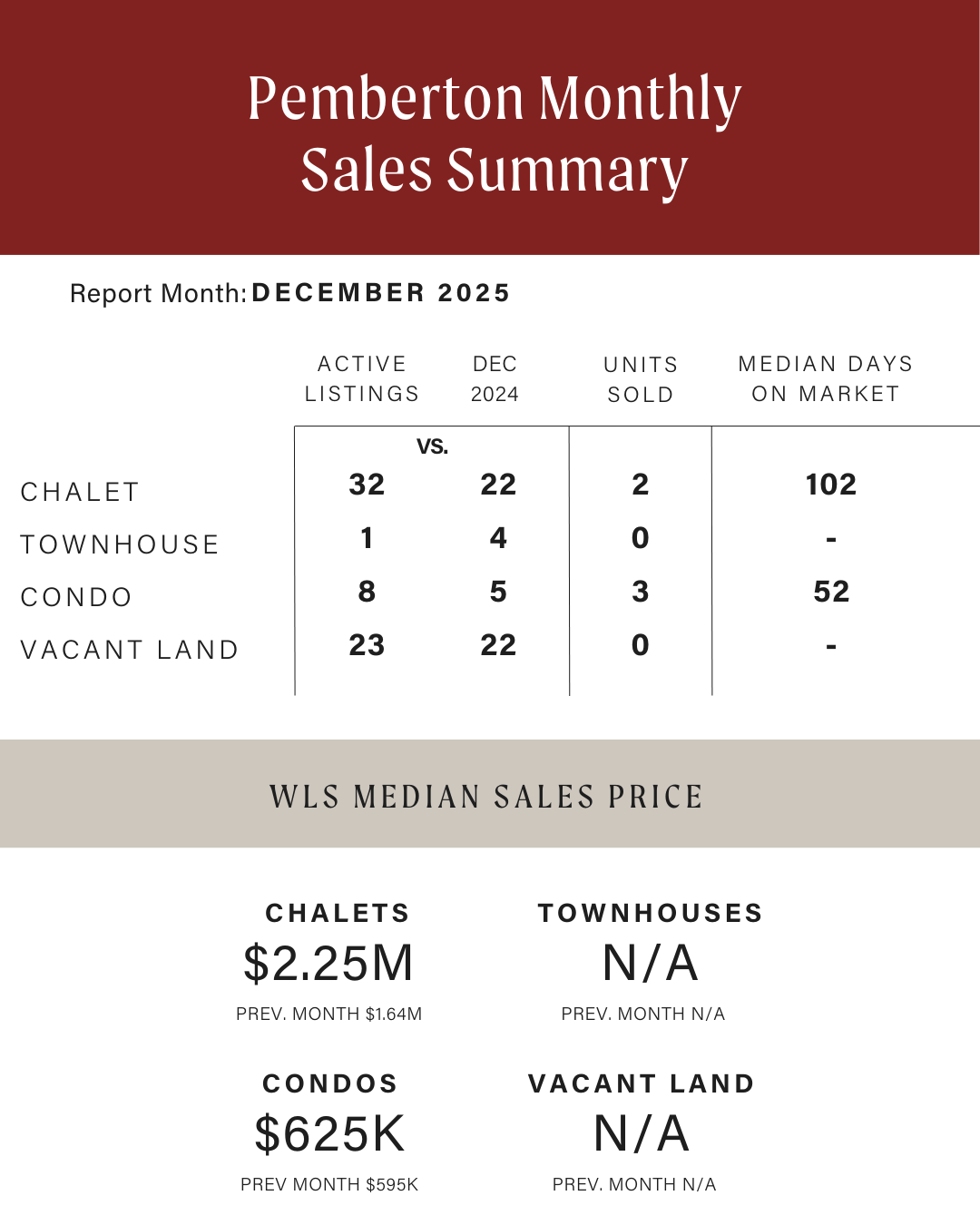

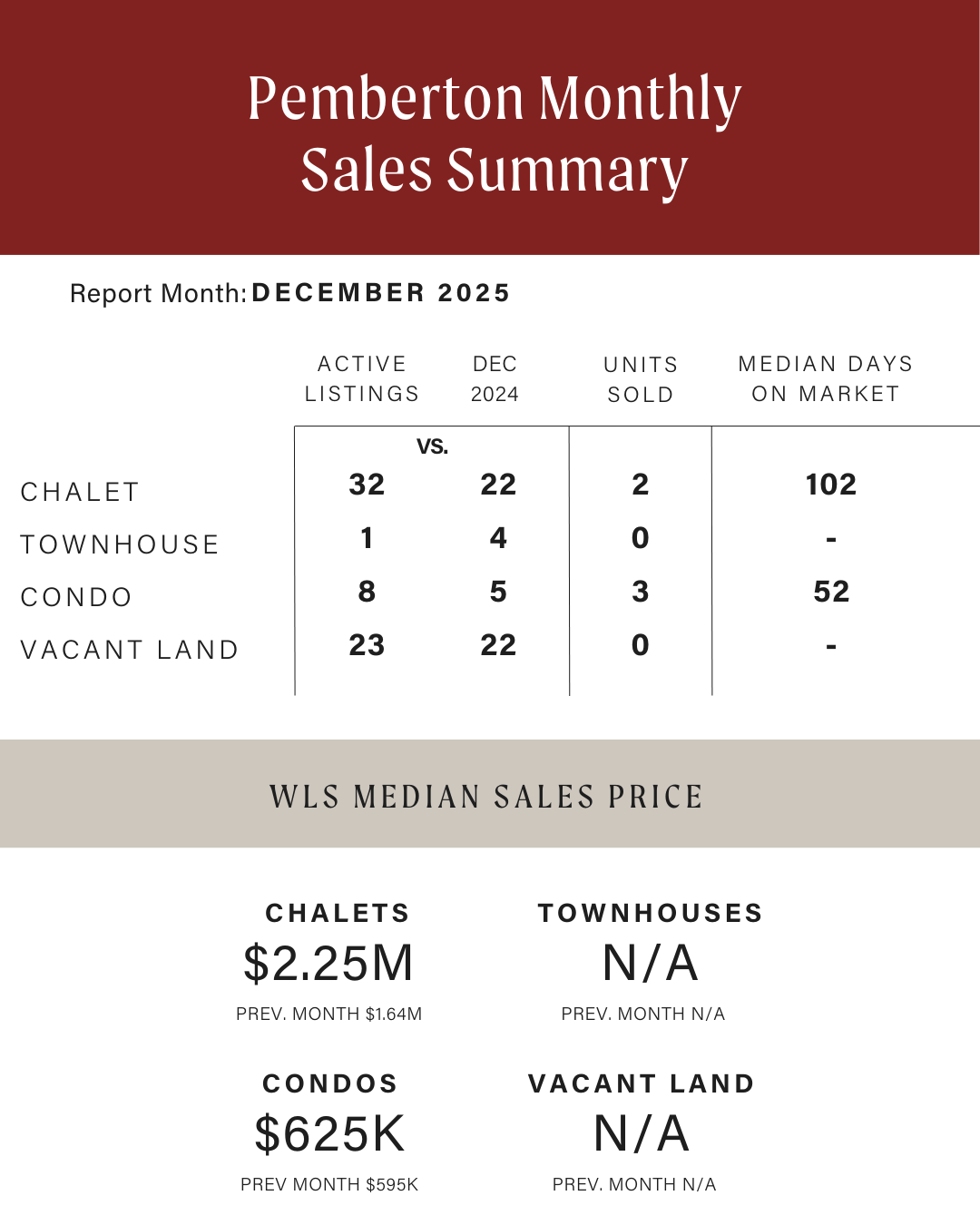

Pemberton Market Snapshot – December 2025

December followed a familiar seasonal pattern in Pemberton—holiday distractions, winter weather, and fewer buyers actively shopping between snowfalls. What stood out this year, however, was just how tight inventory became by month end.

Active listings were higher than December 2024 in most categories, but sales activity remained limited. Chalets finished the month with 32 active listings (up from 22 last year) and only 2 sales, resulting in a median 102 days on market. Condos showed the strongest activity relative to supply, with 8 active listings, 3 sales, and a median 52 days on market. Townhouses and vacant land recorded no sales, despite 1 active townhouse and 23 vacant land listings—proof that even great dirt sometimes requires patience.

Where sales did occur, pricing held firm. The median chalet sale price reached $2.25M, up from $1.64M the previous month, while condos posted a median price of $625K, compared to $595K in November. With limited transactions, these figures are best viewed as directional rather than trend-setting—but they continue to reinforce how strongly pricing is being influenced by low supply rather than soft demand.

From a market balance perspective, December closed with chalets and townhouses in buyers’ market territory, vacant land also favoring buyers, while condos shifted into a sellers’ market, driven by scarce inventory and steady end-user demand.

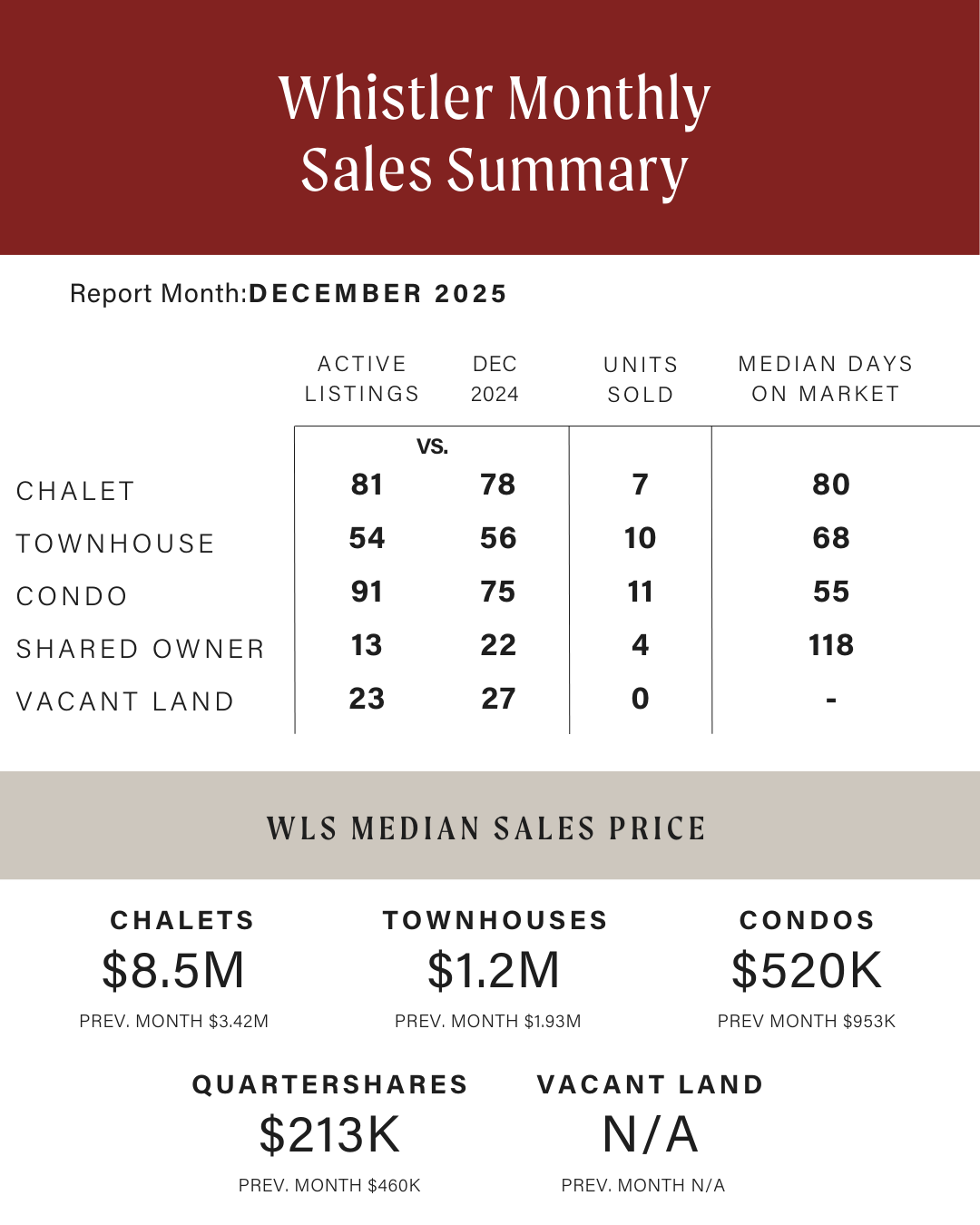

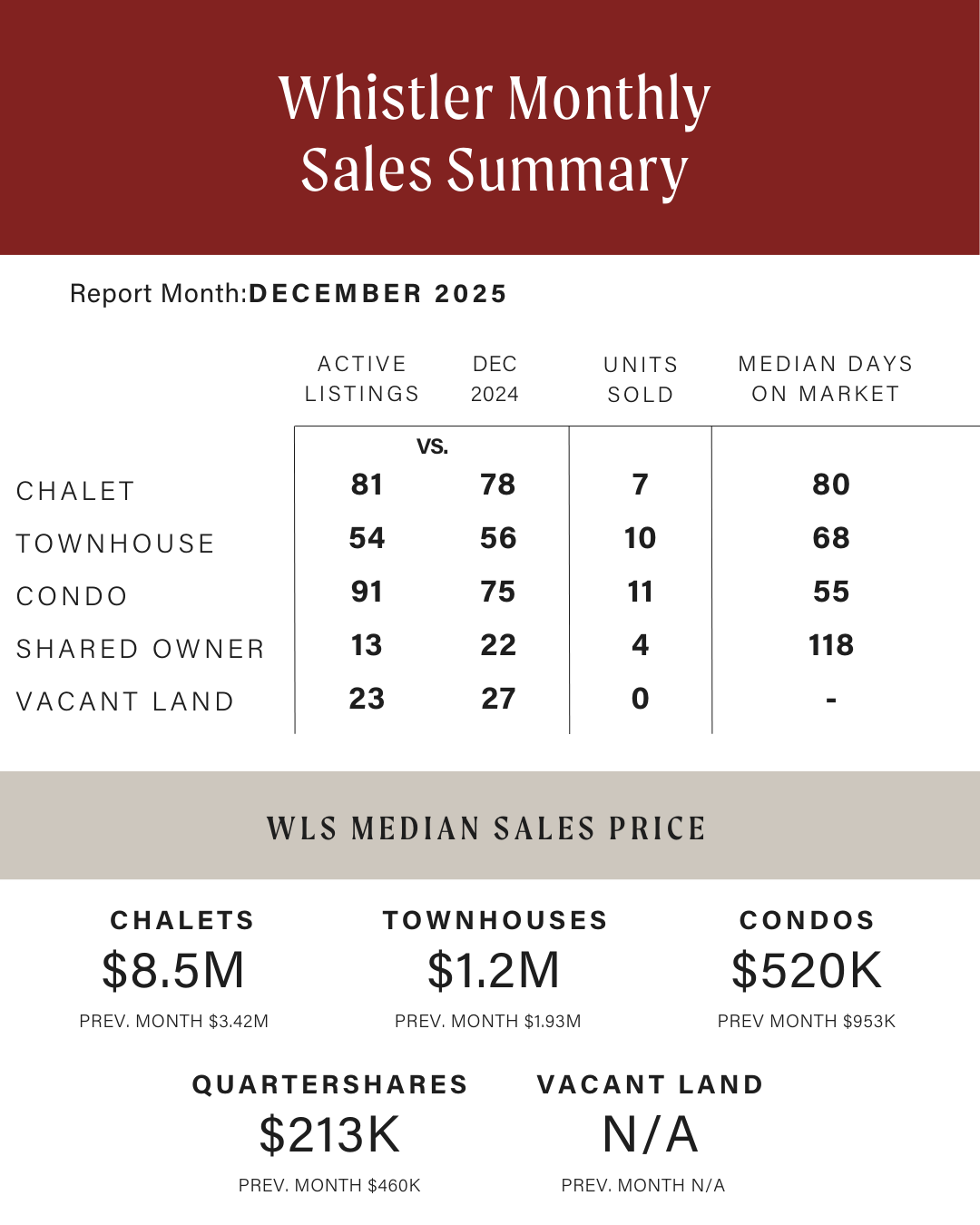

Whistler Market Snapshot – December 2025

Whistler wrapped up the year with conditions largely consistent with what we’ve seen throughout 2025: selective buyers, steady pricing for well-positioned properties, and continued sensitivity to inventory levels.

At month end, Whistler recorded 81 active chalet listings, 54 townhouses, and 91 condos—each modestly higher than December 2024. Sales activity remained measured, with 7 chalet sales, 10 townhouse sales, and 11 condo sales. No vacant land transactions were recorded.

Days on market continue to tell an important story. Chalets posted a median 80 days, townhouses 68 days, and condos 55 days, highlighting stronger absorption in more attainable segments. Shared ownership recorded 4 sales with a longer 118-day median, reinforcing the importance of realistic pricing and strategic positioning in that category.

Median pricing fluctuated month over month, influenced more by the mix of sales than any broad shift in values. Chalets recorded a median sale price of $8.5M, compared to $3.42M in November, while townhouses came in at $1.2M and condos at $520K. Quarter-share pricing softened to a $213K median. December tends to exaggerate these swings due to lower sales volume—so think “snapshot,” not crystal ball.

From a market balance perspective, chalets and vacant land continue to favor buyers, townhouses and condos remain closer to balanced conditions, and shared ownership stood out as a sellers’ market due to limited inventory.

Three Trends Sellers Should Pay Attention to Right Now

As we move toward spring 2026, a few clear patterns are emerging for sellers across the Sea-to-Sky. First, pricing accuracy matters more than ever. Buyers are well-educated, cautious, and quick to pass on listings that feel even slightly out of step with comparable sales. Homes priced correctly from day one are seeing stronger engagement and fewer price adjustments later.

Second, presentation is no longer optional. Properties that show clean, bright, and “ready to move into” continue to outperform—regardless of price point. Even modest improvements, strategic staging, and professional photography are directly impacting days on market and buyer confidence.

Finally, timing and strategy are becoming just as important as the property itself. With inventory expected to rise modestly in spring, sellers who plan ahead—rather than react—are better positioned to capture attention before choice increases and competition returns.

Looking Ahead

Across the Sea-to-Sky, local boards and BCREA are signaling a cautious but constructive outlook for 2026. Buyer confidence is gradually improving as borrowing costs stabilize, but buyers remain value-driven and selective. Inventory—and how quickly new listings come to market this spring—will be a key driver of competition, pricing, and days on market.

A more detailed year-end market report for both Pemberton and Whistler, including broader Sea-to-Sky and provincial insights, is currently in progress and will be shared later this month once final data and forecasting research are complete.

If you’d like help reviewing your BC Assessment, understanding how today’s market conditions affect your property value, or mapping out a smart plan for selling in 2026, I’m always happy to connect.

Warm regards,

Lisa Hilton