Whistler & Pemberton Market Update

Q3 2025 – With a Dash of Mountain Magic (and a Little Ottawa Drama)

Winter is just around the corner, and while the mountains are gearing up for snow, the real estate market is warming up in its own quiet, steady way. Q3 brought a blend of stability, shifting inventory patterns, and—believe it or not—a plot twist from Ottawa that could reshape early 2025.

Let’s start in Whistler, where the chairlifts aren’t the only things preparing to rise.

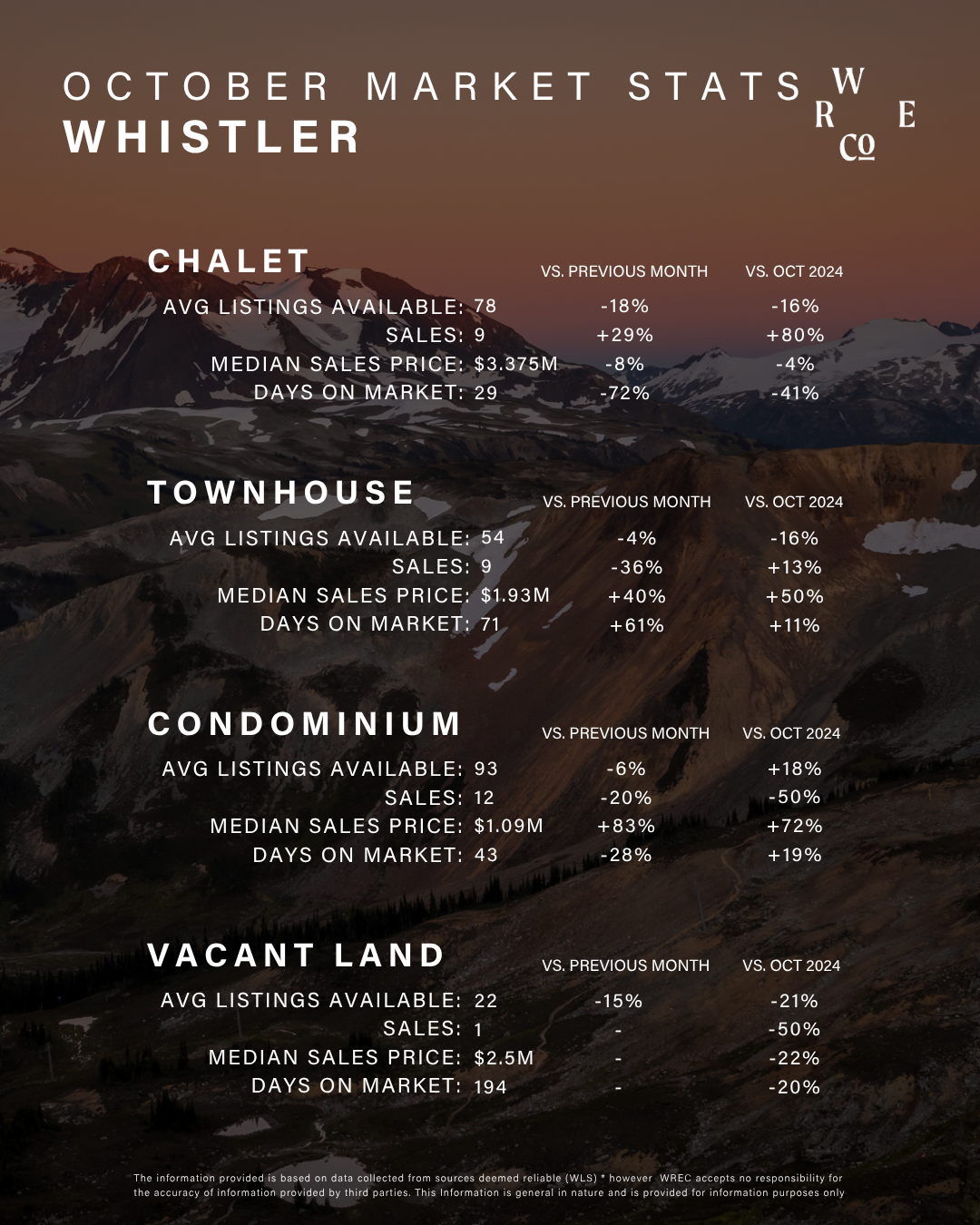

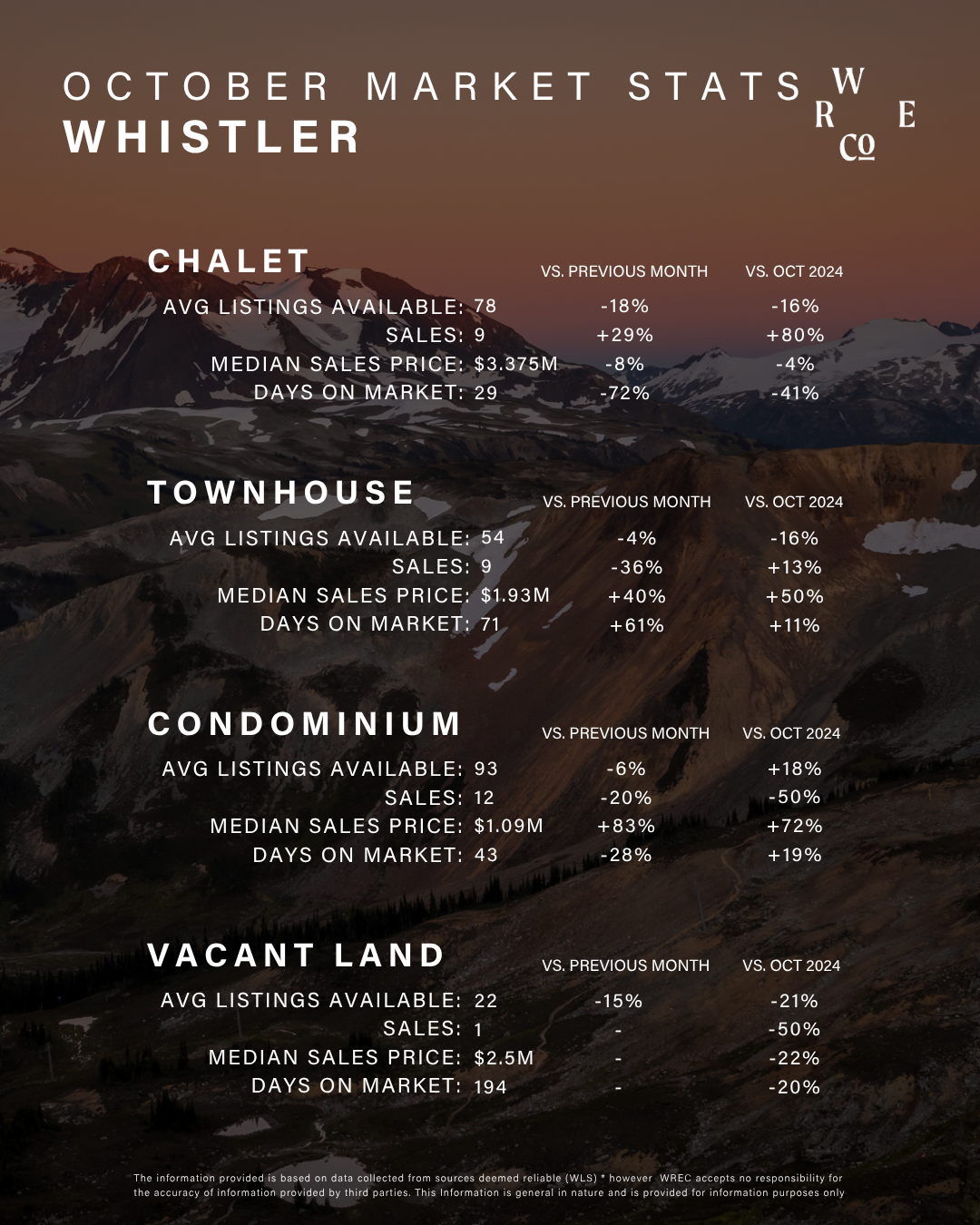

🏔 WHISTLER MARKET UPDATE

Steady Steps, Strong Signals & One Big Tax Disappearing Act

Whistler moved through Q3 at a calmer pace, with 106 sales—a touch softer than Q2, but holding remarkably steady considering the year we’ve all had. Inventory sits at 320 homes, about 4% fewer than last year, creating a surprisingly balanced backdrop for both buyers and sellers.

And then, the fun part: the inventory story.

📊 Inventory Shifts That Tell a Bigger Story

Townhomes: ↓ 22% YoY — people are holding onto these like season-pass holders on a powder day.

Condos: ↑ 32% YoY — but not all condos are created equal…

Phase 2 (hotel-style) units: Nearly double last year’s inventory.

Phase 1 (nightly rental) units: ↑ 20%

This pattern has been clear for months: buyers love revenue properties, while hotel-style units have been piling up as investors waited for interest rate clarity.

And now? The script just flipped—thanks to Ottawa.

🏛 Big News: The UHT Is Gone (Yes… GONE.)

In a move reminiscent of the “Tariffs on. Tariffs off. Tariffs on again… just kidding,” Ottawa announced through a Ways and Means Motion that the Underused Housing Tax (UHT) is effectively switched off:

No UHT payable starting in 2025

No UHT returns required starting in 2025

Full repeal planned for 2035

And yes, the nation collectively sighed with relief (especially accountants)

This is like telling Whistler investors:

“That complicated tax you never wanted to accidentally file incorrectly? You’re free. Go forth and buy vacation homes again.”

Expect this change to move the needle—where Phase 1/Phase 2 product may see stronger absorption and upward pressure on pricing, simply because one of the biggest friction points has vanished.

🌎 Who’s Buying in Whistler Right Now?

Your charts tell the story beautifully:

Whistler & Sea to Sky: 37%

Vancouver: 22%

BC Other: 16%

North Shore: 11%

USA: 8%

Canada Other: 4%

International: 2%

A full 86% of buyers are from BC, staying true to our long-standing trend. Local roots still run deep.

💎 Luxury? Still Sparkling

Q3 saw:

9 sales over $4M

4 sales over $5M

A top sale of $12.65M

And WREC holding the luxury throne with 36% market share

Apparently, luxury buyers did not get the memo that the market was “slow.”

✨ Whistler’s Takeaway

This market is balanced, stable, and quietly powerful.

Rates have nudged down (overnight rate now 2.25%, bank rate 2.50%), confidence is returning, and the removal of the UHT is poised to add fuel to the early 2025 market—especially for resort condos.

For sellers: pricing stability remains your friend.

For buyers: this is the calm window before winter activity returns with a roar.

🌾 PEMBERTON MARKET UPDATE

More Choice, Softer Prices & A Very Local Dynamic

Pemberton felt more subdued in Q3, with 26 sales—up slightly from Q2 but quieter than last year. Inventory has climbed to 82 homes (57 excluding land), the highest in over a year.

Internal Market Report - Q3 2025

This means something Pemberton buyers haven’t had in a while: options.

📉 Pricing Trends

Across the board:

Single-family homes: ↓ 12% YoY

Townhomes: ↓ 4% YoY

Condos: ↓ 14% YoY

This is the most buyer-friendly Pemberton has felt in years.

🌎 Who’s Buying in Pemberton?

Pemberton locals: 53%

Whistler/Sea to Sky: 28%

Vancouver: 7%

BC Other: 6%

Canada Other: 3%

International: 3%

Just as the report shows, 82% of buyers come from right here in the corridor. Pemberton remains deeply community-driven.

💎 Luxury

The top sale this quarter was $2.45M—the fifth over $2M this year.

Even in a slower pace, the upper end continues to find its buyers.

🌤 Looking Ahead

Between the fresh rate cut, the end of the UHT, and a shift toward more optimistic buyer sentiment, both markets are stepping into Q4 with more confidence than we’ve seen all year.

🌟 The Big Picture

Whistler

Balanced, stable, and poised for a busier winter season.

The UHT removal is likely to boost Phase 1/Phase 2 activity and place upward pressure on pricing in early 2025.

Pemberton

A buyer-leaning market offering strong selection and softened pricing—rare opportunities for those who’ve been on the sidelines waiting for the right moment.

Between the mountains, the meadows, and now… Ottawa’s sudden holiday gift of tax relief, Q4 is already shaping up to be more interesting than expected.

Referrals are how my business grows—and how I keep helping families find their perfect place.