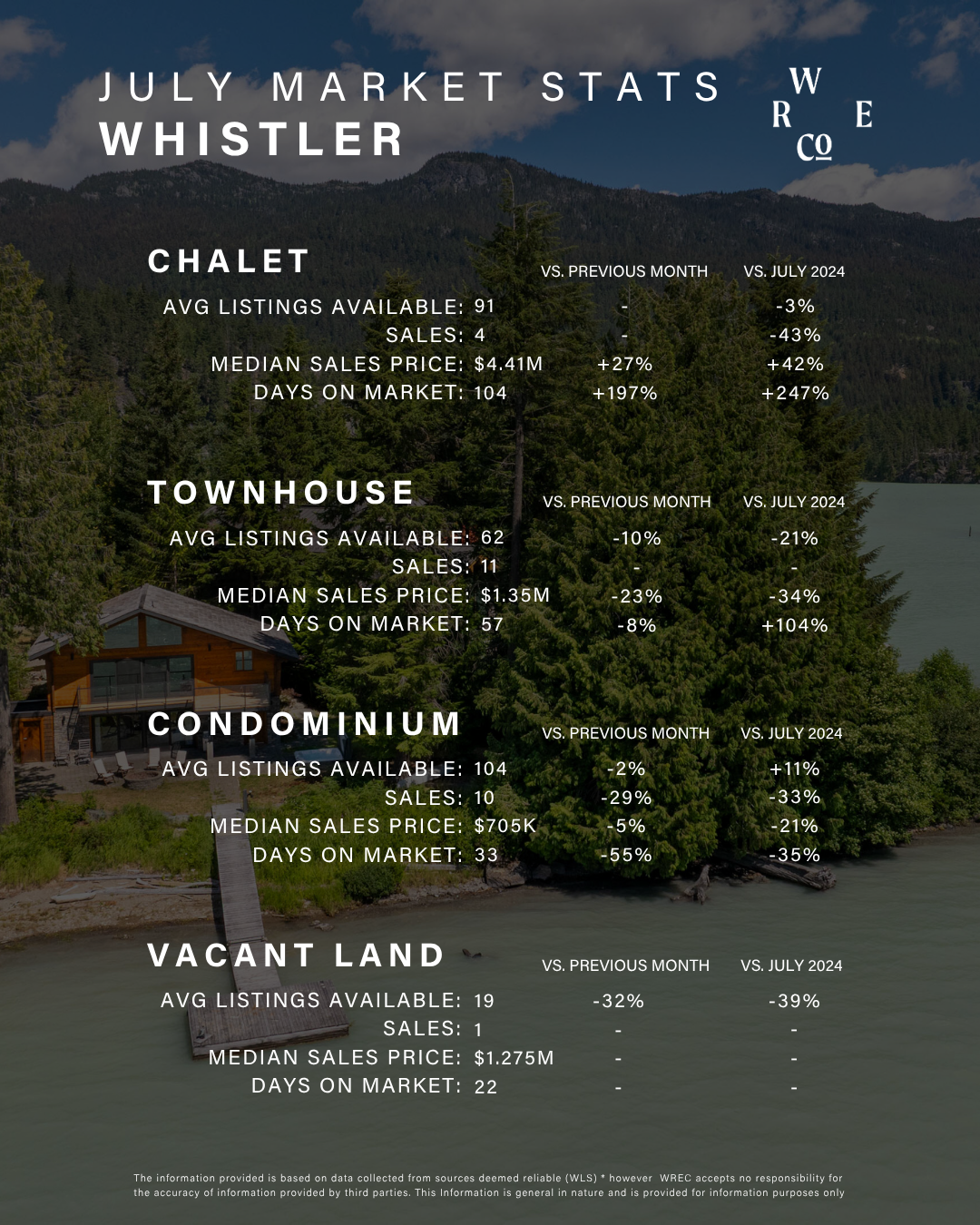

Whistler Market Highlights

July brought a seasonal slowdown with 31 sales, down 9% year-over-year and 35% below the 5-year July average. Inventory dipped to 315 active listings (down 9% from last year).

Single-family homes: Median sale price rose, driven by luxury deals, but days on market jumped to 104.

Townhomes: Median 57 days on market.

Condos: Fastest at just 33 days on market.

The market currently leans buyer-friendly for single-family homes and condos, while townhomes remain balanced.

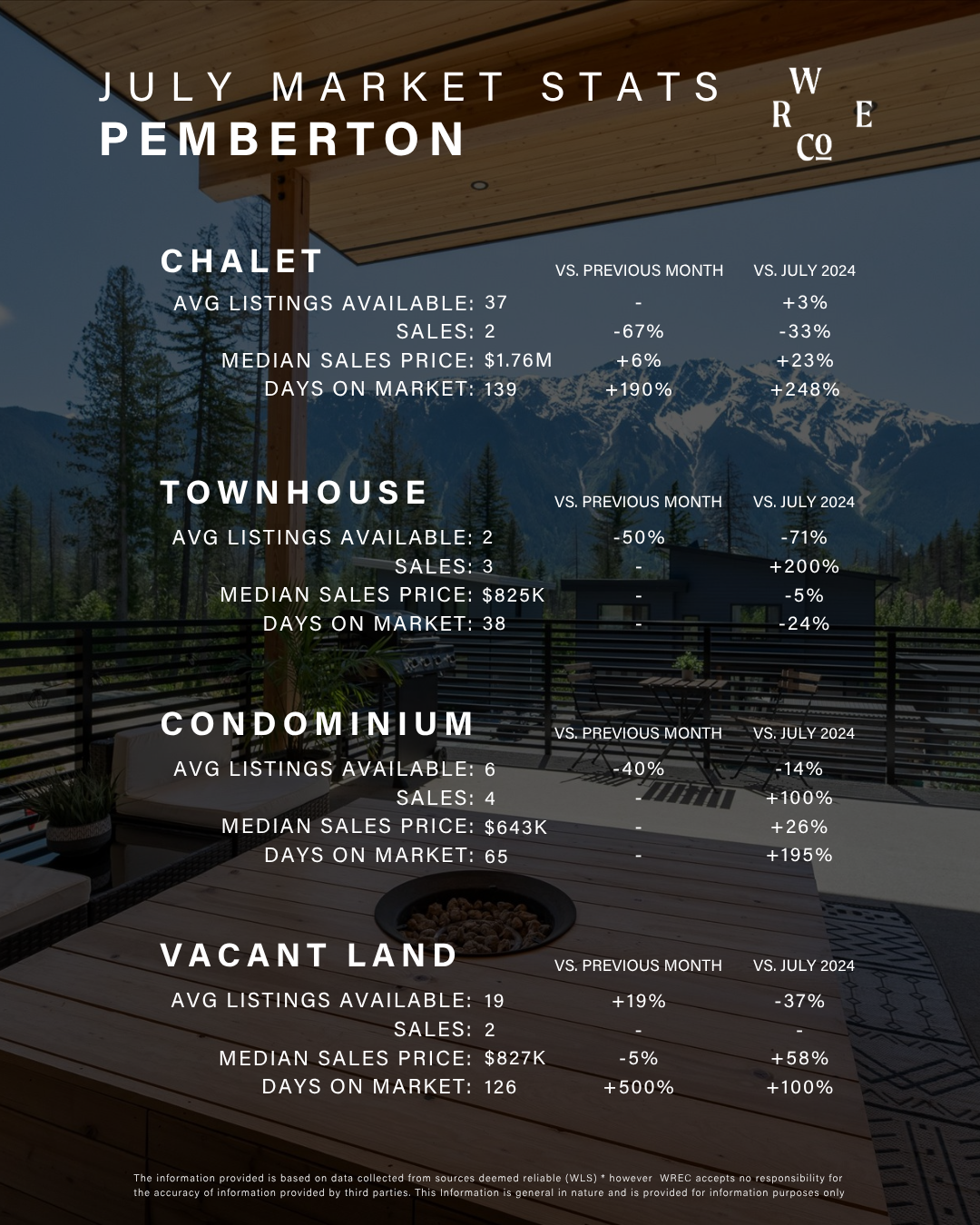

Pemberton Market Highlights

Sales activity was stronger here, with 13 sales in July—the highest since October 2024 and 9% above the 5-year average. Active listings fell to 70 units, down 20% year-over-year.

Single-family homes: Averaged 139 days on market.

Condos: Averaged 65 days.

Townhomes: Fastest movers at just 38 days.

Overall, Pemberton remains balanced, though inventory is tightening.

Economic & Market Context

The Bank of Canada held interest rates steady in July, the third consecutive no-change announcement. Despite global headwinds like new U.S. tariffs, steady borrowing costs and strong domestic tourism continue to support housing demand.

Unlike Metro Vancouver, where inventory rose nearly 20% compared to last year, both Whistler and Pemberton saw inventory declines—limiting options for buyers.

Deeper Dive: Sea-to-Sky Trends

Across Whistler, Pemberton, and Squamish, the market remains balanced with pockets of buyer opportunity—especially for acreages and new construction. Higher borrowing costs have slowed activity, but well-priced homes are still selling quickly.

In 2024, Whistler’s overall sales were stable but lower than historical highs, while inventory growth gave buyers more negotiating power, especially in the luxury segment.

Interest Rate & Housing Outlook

CMHC forecasts a 2% decline in Canadian home prices for 2025, with sharper drops in B.C., followed by recovery in 2026.

TD Economics expects slower price declines in the second half of 2025, with potential stabilization.

CREA projects modest national price increases of ~2.8–3.0% in 2025–2026, though B.C. is expected to underperform.

CBRE anticipates rate cuts later in 2025 as the Bank of Canada moves toward neutral (2.25–3.25%).

Takeaway: Expect a softer market through 2025, especially in luxury Whistler and Pemberton properties, with stabilization or modest recovery by 2026. Rate cuts could improve affordability, but supply constraints and high prices remain key challenges.

Thinking About What’s Ahead?

If you’re wondering how these market shifts and interest rates impact your property’s value or buying power, I’d be glad to prepare a personalized “What’s My Home Worth” update. Let’s chat!