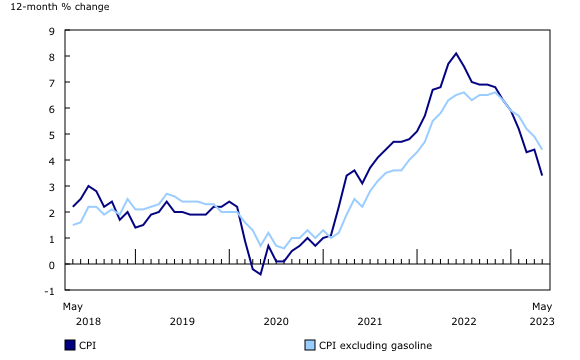

May 2023 Inflation Drop: The latest economic reports indicate that the inflation rate for May 2023 experienced a significant drop compared to previous months. This unexpected decrease in inflation suggests a temporary easing of price pressures across various sectors of the economy. The decline in inflation can be attributed to a variety of factors, including improved supply chain dynamics, stable energy prices, and a general moderation in consumer spending.Impact on Interest Rates: The drop in inflation for May 2023 could have implications for interest rates. In many cases, central banks and monetary authorities closely monitor inflation trends when making decisions about interest rates. When inflation is high or rising rapidly, central banks tend to increase interest rates to control price levels and curb potential economic overheating. Conversely, when inflation is low or decreasing, central banks may consider lowering interest rates to stimulate economic growth.In the context of the May 2023 inflation drop, it is possible that central banks and monetary policymakers will reassess their stance on interest rates. Lower inflation rates provide an opportunity for central banks to consider reducing interest rates as a means to encourage borrowing, investment, and overall economic activity. However, it is important to note that central bank decisions are influenced by a multitude of factors, including employment levels, GDP growth, and financial market conditions, among others.What it Means for You: The potential impact of the May 2023 inflation drop on interest rates can have both positive and negative implications for individuals and businesses. If central banks decide to lower interest rates, it could lead to reduced borrowing costs for individuals seeking mortgages, car loans, or personal loans. Lower interest rates may also support business investment and spur economic growth. However, the actual implementation of any interest rate changes will depend on the specific monetary policies adopted by central banks in response to the broader economic landscape.Conclusion: As always, we will continue to monitor economic developments closely and keep you informed about any significant changes in interest rates and their potential implications. We encourage you to stay updated on the latest financial news and consult with professional financial advisors to make informed decisions based on your individual circumstances.Thank you for your continued trust and support. Should you have any questions or concerns, please do not hesitate to reach out to us.